Initial Coin Offerings (ICOs) Explained

What are Initial Coin Offerings (ICOs)?

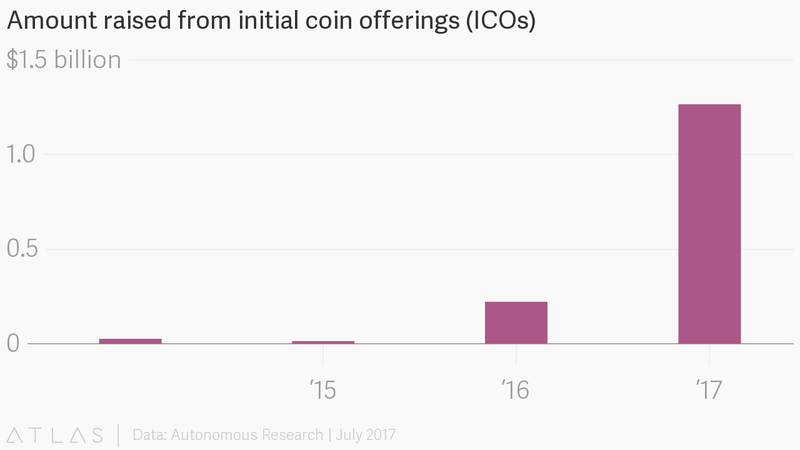

Initial Coin Offerings (ICOs) have raised $1.3 billion dollars in 2017, a number so quick to market that the space is being branded the next tech bubble.

Initial Coin Offerings (ICOs) have raised $1.3 billion dollars in 2017.

ICOs provide startups an alternative method of raising capital compared to the traditional process involving banks, private equity, and venture capital firms. These companies, occasionally referred to as crypto projects, issue tokens of their initial coin supply – as opposed to stock in exchange for cash – to investors who have given them capital for their project development.

ICOs routinely take place before a project is even completed because the raised funds help the company scale and cover expenses. Similar to a traditional stock portfolio, the potential for massive future payoffs incentivizes investors to buy tokens, hoping that the tokens originally bought will rise in value.

It's not hard to see why many crypto-projects prefer ICOs to traditional capital raising. In 2014, Ethereum, a blockchain application built to optimize smart contracts, raised over $18 million in Bitcoin during its ICO and currently has a market capitalization of over $19 billion.

This number dwarfs the $358 million in traditional venture capital money that went to blockchain startups over the same period.

A month later, Filecoin raised over $250 million in just over an hour.

While many investors have embraced ICOs by jumping in head-first, others remain skeptical -- citing security, legal, and fraud issues. These fears are not unfounded but have largely been overblown and are in the process of being addressed by the Securities and Exchange Commission's (SEC) new guidance in the regulation of fraudulent cryptocurrencies.

Investors generally refer to these security fears as a primary reason for avoiding ICOs. In 2016, the Decentralized Autonomous Organization (DAO), a cryptocurrency software venture capital fund, lost $50 million after its platform was exploited by hackers.

The DAO’s ICO was drained through an exploitation of the smart contracts which allowed money to be transferred before the internal token balance was updated. The money was later returned to investors through a hard fork, resulting in the formation of Ethereum Classic before the DAO was shut down.

In a more recent incident, CoinDash, an operating system for trading crypto assets, lost $7 million after hackers changed the wallet address on the website diverting funds to their own pockets.

SEC Ruling

In order to establish better security and suppress the volatility around the value of these ICOs, the SEC has issued a statement to distinguish ICOs as either a functional coin (utility) or a raise (security).

The report urges companies/crypto projects to register with the SEC to determine whether the ICO is a security. If the token is deemed a security, the ICO must comply with SEC regulations because they are technically considered to be an investment.

The ICO must comply with SEC regulations because they are technically considered to be an investment.

Tokens not deemed securities/investments may not have to register with the SEC. These are tokens typically acquired with little to no expectation of profit (no equity or dividends exchanged). For example, tokens that have actual utility on a blockchain network such as Ether may not be considered investments.

The SEC’s ruling is an attempt to equip prospective investors with tools helping them to avoid scams and fraud by bringing regulation to a previously unregulated marketplace: a process that includes reconciling prior regulation to an emerging technology with very little legal precedent.

One such case that highlights much of the onus of the SEC’s response involves Onecoin, a company asserted to be one of the most notorious ICO scams. Previously marketed as “better than Bitcoin”, Onecoin is a great example of an ICO wherein traditional diligence may have alluded to potential problems in the company. Onecoin raised large amounts of money by claiming to have underlying blockchain technology with guaranteed returns by improving on Bitcoin’s flaws.

In reality, there was no blockchain in place: no underlying proof mechanism that maintained the volume of cryptocurrency, administered its distribution and up kept transparency. Unfortunately, many unassuming investors did not verify Onecoin’s claims and were drawn into the scheme. Currently, India is preparing to charge almost 30 perpetrators, including CEO Ruja Ignatova.

Blockdaemon’s involvement with an ICO

ICOs allow crypto projects to deploy crowdfunded capital on their own terms. However, structuring a smoothly run ICO is a very intricate process. BlockDaemon, a startup that allows enterprises to deploy applications to blockchains and cloud platforms, mentions that ICOs are able to fund research and development projects targeting specific structural problems within an industry when traditional venture capital firms might not be willing to fund research projects.

However, based on their prior involvement with an ICO, the need of an accountability is important to ensure that the team is incentivized to work once they’ve raised the money. This is where having a VC benefits the startup, as it holds them accountable.

Future ICO regulations

Due to the large influx of funds, other countries will likely soon follow suit with a ruling on ICOs that could profoundly impact where the majority are based. The SEC ruling was only just the beginning of the regulatory response to the burgeoning market.

ICOs present a double edged sword: on one hand, they enable startups to raise money through unconventional means across the world. On the other hand, investors are left vulnerable to scams and poorly put together crypto projects. Ironically, many of these similar problems were felt and later addressed by the 1933/34 U.S. Securities Act: a piece of regulation implemented to standardize the process and protections afforded to the investor.

If you’re a startup interested in joining one of our world-class accelerator programs, apply here. If you’re a corporation seeking innovation, join us here.